| NATURAL MONOPOLIES | |

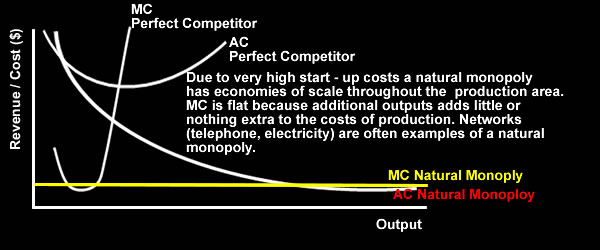

A NATURAL MONOPOLY is a firm that has economies of scale throughout the production range due to extremely high start- up costs, meaning that the AC curve is declining throughout the production range and MC is insignificant for each additional unit of production. A Natural Monopoly can supply the market more efficiently and at a lower cost than two or more firms. A Natural Monopoly may be more efficient than a perfect competitor because of the very high start up costs it may be inefficient for more than one firm to supply the market. |

|

|

|

The Social Desirability of Natural Monopolies A rational producer will not incur unsustainable losses - it will not operate below the AC curve in the long run nor the AVC curve in the short run. P<AC No rational, privately owned business could stay in business under these conditions. But what if it was considered socially desirable for the economy to have this product or service? Suppose it was a nationwide energy grid that would boost economic growth? Then the government may provide the good / service, especially where very high startup costs are involved. Once demand increases and economies of scale start to appear the government may then sell off the natural monopolies. Examples of this include: - Telecom - Electricorp The government can also separate the natural monopoly area of the firm to ensure it can't take advantage of its market position. Chorus was separated from Telecom to stop Telecom over charging other firms from using its telephone lines. The government is the provider of the fibre roll out for broadband to ensure no one provider can monopolise the fibre network |

|

Socially Desirable Monopoly Equilibrium and Government Intervention The socially desirable equilibrium quantity occurs when MC= AR. Firms will maximise profit where MC = MR, and, with a downward sloping demand curve, MR is always below AR. This would imply that only perfect competition is socially desirable, yet the majority of New Zealand industries sell in an imperfect market. A monopolist operates in the most imperfect market that can exist. Should the government choose to intervene, it has a number of measures available with which to force the privately owned monopoly away from private profit maximisation towards the socially desirable equilibrium. |

|

||

|

| AVERAGE COST PRICING | |

Price is regulated to the point where P = AC, the monopoly would make a normal profit or a ‘fair rate of return’.

It is however; difficult to know what a fair rate of return would be. The government can look at the private sector and see what a fair rate of return could be for a firm in a similar industry. |

|

| MARGINAL COST PRICING | |

Marginal Cost Pricing – The government can regulate to a fair rate of return and force a monopoly to price its product where P = MC or MC = AR, just like in perfect competition. This would help the market to achieve allocative efficiency. |

|

| OTHER METHODS TO CONTROL A NATURAL MONOPOLY | |

| PUBLIC OWNERSHIP | |

Where the private market cannot provide a socially desirable good or service. (ii) Breaking a socially undesirable monopoly. |

|

Nationalisation |

|

GOVERNMENT POLICIES TO INCREASE COMPETITION. Deregulation and isolating the natural monopoly components of a firm. Deregulaion that occurred in the 80’s and 90’s was intended to make the monopoly behave in a competitive way. |