| Markets In The Circular Flow |

|

The Circular Flow diagram also shows the interaction of four markets.

|

|

TYPES OF MARKET IN THE CIRCULAR FLOW MODEL There are four main types of market |

| THE GOODS AND SERVICES MARKET |

| This is where producers sell finished goods and services to consumers. |

| Consumers buy goods and services (commodities) from producers and in return they spend their income (Consumption or consumer spending). |

| The flow of money (consumption) from households in return for commodities from producers takes place in the goods and services market. |

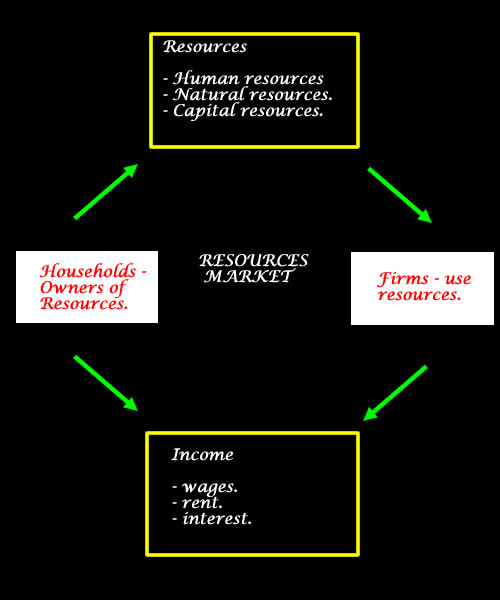

| THE RESOURCES MARKET |

| The resource market is where

resources are bought and sold Households own the resources used in production. Households provide the resources and in return they receive an income or a factor reward. The level of income received will depend upon the amount of demand for the resources. The demand for a resource is a derived demand. This means that there is no direct demand for resources, the demand is derived (comes from) the demand for the goods and services the resources make. The returns or incomes to owners of the resources are

|

|

| THE MONEY MARKET |

| The money market connects savers

(households who save money), financial institutions (banks etc) and firms.

Money flows from savers to financial institutions and then onto borrowers (which includes firms as they invest and consumers as they spend on credit). Money flows back from firms to financial institutions when interest is paid and the principal is repaid. The price of money is the interest rate (%) and is determined by the supply and demand for money. Interdependence between the financial sector, firms and households. |

| Households save money (this is money not spent on consumer goods and services) and then deposit it into a financial institution (e.g. banks, managed funds). Savings are a withdrawal of money from the circular flow as the money is taken out. An increase in savings will lead to a decrease in consumption and so money is removed from the circular flow |

| The savings by households ill then be used by the financial sector. Banks and other institutions will lend the money to firms as investment. Firms use this money to buy capital equipment and as venture finance (the money used to start up new companies). |

| The financial sector acts as an intermediary - it takes savings from households and lends the money to firms for investment. Firms rely on households for the money to purchase capital goods (investment) and households rely on the financial sector for interest payments for the money they have saved. |

| THE FOREIGN EXCHANGE MARKET |

| This is the market that

corresponds with the overseas sector. Whenever NZ producers trade overseas, money changes hands, but different countries use different currencies (types of money). For example if Australian consumers wish to buy New Zealand Kiwifruit then they will need to pay NZ producers in New Zealand currency (money). They will exchange Australian currency on the Foreign Exchange Market for New Zealand currency to purchase New Zealand Kiwifruit. Like wise if NZ consumers want to buy Japanese cars then they will need to change New Zealand currency into Japanese currency. On the Foreign Exchange Market they will change New Zealand dollars into Japanese Yen so that they can pay Japanese producers and purchase the cars. |

|

|

| The value of the New Zealand dollar is determined on the foreign exchange market. |

| If there is high demand for the New Zealand dollar, then there will be an increase in its value. |

| This is called an APPRECIATION of the New Zealand dollar - the value of the dollar has increased and now it is more expensive to buy New Zealand's products (our exports), but it is cheaper for New Zealanders to buy overseas products (imports). |

| So if the value of the dollar appreciates then New Zealand will probably export less and import more. This will mean that there will be more withdrawals of money from the New Zealand economy. |

| If there is there is a depreciation of the New Zealand dollar (the value of the dollar falls) this will make exports cheaper for overseas customers and imports more expensive. |

| This will have the opposite effect of an appreciation. It will result in an injection of money into the economy which will help to increase New Zealand producers profits and create employment. |