| The Circular Flow of the Economy |

| Objectives:

By the end of this section you will be able to:-

|

| The

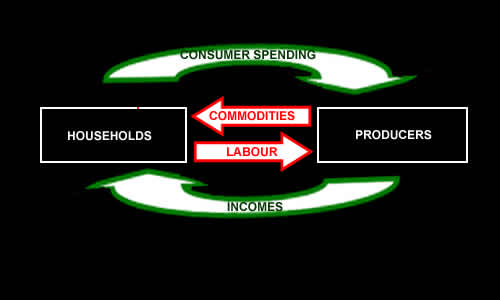

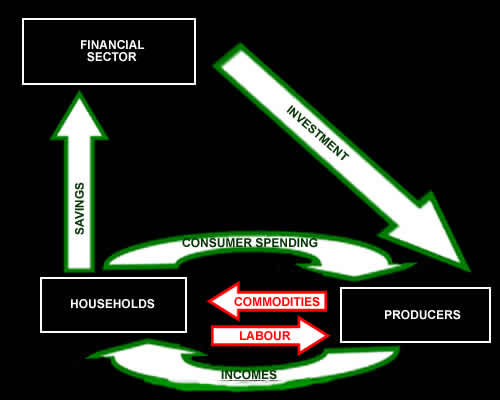

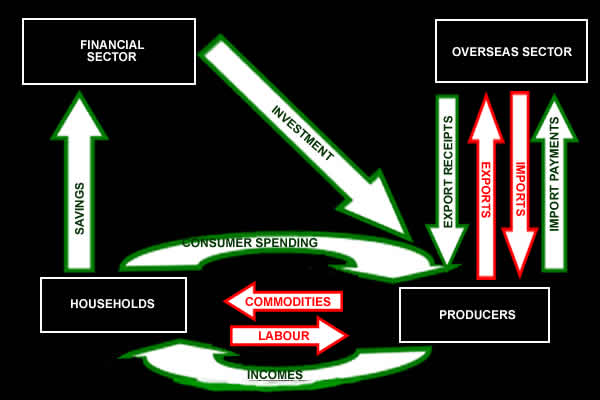

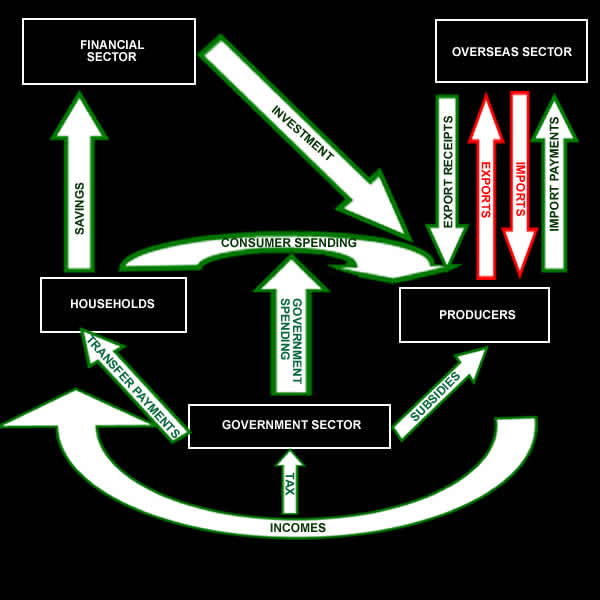

circular flow model shows how the FIVE different sectors of the economy are

linked. We will be looking at both money flows and real flows. Real Flows look at the flow of physical things through the economy. In the Circular Flow Model they are - Labour (the flow of resources. - Commodities - Exports - Imports Money Flows look at the flow of money through the economy. Some of the money flows are linked to real flows. In the Circular Flow Model they are - Income (linked with labour) - Consumer spending or consumption spending (linked with commodities). - Savings - Investment or Venture Finance. - Government Spending - Taxes - Transfer Payments - Subsidies - Export Receipts (linked with Exports) - Import Payments (linked with Imports). |

| Households and producers |

| Households and producers rely on each other. Households rely on Producers for Income and Commodities and Producers rely on Households for Labour and Consumption Spending. There is a mutual dependence - they are interdependent. Households rely on producers for Income and Commodities and produicers rely on households for Labour and Consumer Spending. |

|

| Financial sector |

Most people do not spend all their income. Some is saved for future buying. Savings can be deposited in banks or other firms in the financial sector and earn interest. As income increases people tend to save more. The Financial Sector use these savings to make

loans to producers wanting to expand e.g. more buildings, machinery or for

a farmer more land, stock, and fertilizer etc. Investment from the financial sector to producers can also be in the form of Venture Finance. Producers are borrowing to invest in new businesses or or expansion. The Financial Sector makes a profit from the difference between the interest rate they pay savers (e.g. 5 percent) and the interest rate they charge producers (e.g. 7 percent). The financial sector acts as an intermediary between households who want to save money and firms who want to borrow money for investment. |

|

| Overseas sector |

NZ exports a number of goods and services overseas, these include dairy products, beef, lamb, tourism, etc. The exports are part of the real flow. Export Receipts is the money flow that corresponds with the real flow. NZ imports a number of items, these include cars, petrol, fruit etc. The imports are part of the Real Flow and the money flow that corresponds with the real flow is Import Payments. Money flows into NZ producers for exports (export receipts) and out of NZ to overseas suppliers as payment for our Imports. The balance of payments is a measure of how much money is leaving NZ compared to how much money is entering NZ. It shows Export Receipts minus Import Payments. The Balance of Payments records if there is a surplus i.e. Export receipts exceed Import payments; or a deficit i.e. Import payments exceed export receipts. If a deficit results then NZ must borrow the difference overseas. |

|

| Government Sector |

Government spending is large on services like education, health, roads, police, defence etc. Income tax is paid by all wage and salary earners. It is mostly paid using P.A.Y.E. (Pay As You Earn) and is automatically deducted from wages. Income after tax is called disposable income. Company tax must be paid on all profits by firms, including banks (the financial sector). These are direct taxes.like GST also provide money. GST (15% of the price) is paid by producers on all goods and services sold. This increases firm costs, although part of the extra cost is passed on to consumers in a higher price. Indirectb taxes also include excise taxes. These are taxes on alcohol, tabacco etc. and are used to try and discourage their consumption. Subsidies - these are paid to producers to help them to produce a certain type of good or service the Government believes should be produced more. Subsidies enable firms to produce more, charge a lower price, and thereby sell more. In NZ things like the Royal New Zealand Ballet are subsidised by the Government.

|

|

| Interdependence |

| All of the sectors in the circular flow model are mutually reliant - they rely on each other and could not fully operate without the other sectors. e.g firms need the financial sector in order to borrow money for investment so that they can buy more capital goods and expand their firms and continue to rpoduce their commodities. |

| Gross Domestic Product - GDP |

This is the value of ALL goods and services produced in an economy in a year. GDP consists of all of the money flows in the diagram. GDP is equal to ALL of the income earned in the economy in a year (Y = income) or GDP is equal to ALL of the expenditure on ALL goods and services = C (consumption) + I (investment) + G (Government Spending) + X (exports) minus - M (imports) so

|

| When the economy is growing (GDP is increasing) this is called a recovery and when it is growing rapidly this is called a Boom. |

| When the economy has negative growth (GDP is falling) this is called a recession. |

| The Impact of Changes on the Circular Flow |

| An Injection |

| If money is put into the circular flow - by such things as increased investment or export receipts or government spending, then there will be an increase in production, more employment, greater incomes and increased consumer spending - this will cause an increase in GDP and a period of growth. |

| e.g an increase in export receipts. |

| A withdrawal |

| If money is taken out of the circular flow by such things as increased taxes, increased import payments or increased savings then there will be a decrease in production, a fall in employment, falling incomes and decreased consumer spending - this will cause a fall in GDP and a period of low growth or falling growth (a recession). |

| e.g an appreciation of the New Zealand dollar which causes a fall in export and an increase in imports. |