THE GOVERNMENT AND EQUITY

In New Zealand the Government Attempts to achieve equity and equality through a number of interventions.

These include....

Equity of income: a progressive taxation system for income tax, plus GST to ensure that people who can avoid paying income tax must pay at least some tax on their expenditures. Those who are unable to earn income are paid welfare. There are also payments to low to mid income working families with children through working for families tax credits.

Equality of opportunity: through the provision of compulsory primary and secondary education, public hospitals, public libraries, parks and the provision of socially desirable monopolies.

Spending for equity: The government may decide to allocate extra funds to the welfare of specific groups which may be considered underprivileged in order to make up for market inadequacies and to give people an equal chance alongside others.

Redistribution Tools

Tax - Progressive taxation where people on a higher income pay a larger percentage of their income in tax.

Transfers - money paid to low income households to help these include transfers such as the unemployment benefit, housing assistence, disability benefit etc.

Subsidies - financial aid paid to low income households for housing, schoooling etc.

Public provision - free schools and hospitals to provide for all families.

Minimum wages - to ensure all workers are paid at least a basic and "fair"wage.

Affirmative action - policies designed to help disadvantaged groups.

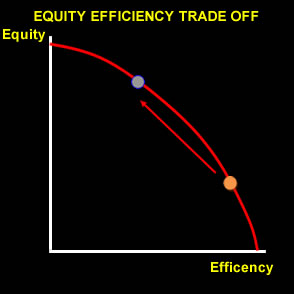

Equity Efficiency Tradeoff.

An increase in equity may lead to a decrease in efficiency. If a taxation system is too progressive with very high marginal rates such as 80%, people may not work as hard because they are not earning much extra income for their efforts.

|

An increase in equity may lead to a fall in efficincy as resources are directed away from one area by the government to other areas. |