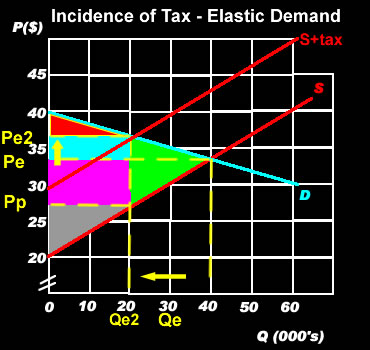

EFFECTS OF AN INCREASE IN INDIRECT TAXES

An increase in an indirect tax such as GST will result in a loss of allocative efficiency.

An increase in an indirect tax will result in a shift to the left of the supply curve and deadweight loss.

The shift of the supply curve to the left means that both consumer and producer surpluses are reduced. Use the image below to see the effects of an indirect tax. |

|

|||||

|

|||||

INCIDENCE OF TAXElasticity of demand will affect how much of a sales tax a consumer or producer will have to pay.IF DEMAND IS ELASTIC – then producers will have to absorb as much of the tax as possible, because they cannot afford to put the price up (any increase in price will lead to a much larger decrease in the quantity demanded). The diagram above shows that with the introduction of a sales tax both consumer and producer surpluses are reduced. The area in green shows the deadweight loss caused by the tax, and the areas in pink and blue show the amount of tax the government receives

|

|

IF DEMAND IS INELASTIC – then producers will be able to pass on a large proportion of the tax onto consumers, because any increase in price will cause a much smaller decrease in the quantity demanded. When demand is inelastic a lot more of the sales tax passes onto consumers. The areas in blue and pink show the total revenue gained by the government from the introduction of the sales tax. Producers absorb a small percentage of the sales tax (the area in pink) and are able to pass a much larger proportion onto consumers (the area in blue). |

|

Calculation of Incidence of an Indirect Tax. Total amount of tax = $7.50 (the verticle distance between the supply curve. Total tax revenue gained by the government (the areas in blue and pink) = $7.50 x 20 000 = 150 000. Incidence of tax on consumers (area in blue) = Incidence of tax on producers (area in pink) = Deadweight Loss caused by the tax (the area in green) is |

|